In a modern, paperless world, getting a mortgage somehow involves more paperwork, even if some documents are sent electronically. The demands also aren’t so great. Only a decade ago, many lenders didn’t do as much verification of a borrower’s employment, income, and liabilities.

While it may take some time to track down what you need and get documents in order, you can speed up the process by collecting these loan documents beforehand. This can help you get to closing your deal sooner. Here’s a guide on what you can expect when applying for a mortgage:

Mortgage Application

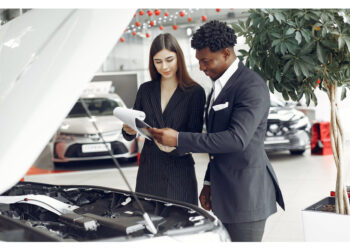

By the time you begin to apply for a mortgage, you probably already have submitted the first round of documents needed for a mortgage pre-approval. Your lender may ask for further documentation, now that you’ve found a home and agreed on a price with the seller. Here, you’ll fill out a Uniform Residential Loan Application, which takes information about each borrower, the home being bought, previous employers, financial situation, and more.

Income Verification

When lenders ask to check a borrower’s income, they’re looking for stability and consistency to ensure the borrower can afford the mortgage payments consistently, with documentation like payslips, W2s from previous employers, income tax returns, alimony or child support documents, and more.

Assets and Debts

Your lender will check your debt obligations to calculate your debt-to-income ratio and will want to make sure you have the assets necessary to be financially sound after paying the down payment and closing costs attached to the mortgage. On the mortgage application, you will list all monthly debt payments like auto loans, student loans, credit cards, and assets, like bank and investment accounts. Your lender may also ask for documents that support these very debts and assets.

Credit Verification

Having your credit verified is a huge part of applying for a mortgage, even though you won’t actually submit a copy of your credit reports. Your lender will ask for your permission to check your credit history and while some dents and scratches won’t prohibit buyers from getting a loan, any late payments, collections, or other such items on your credit reports may cause issues.

Other Records

Your lender may ask for additional mortgage documents, depending on your situation, like rent information, previous accommodation, divorce decrees, thin credit files, bankruptcy, and foreclosure documents if any, and noncitizen paperwork.